Planned Giving

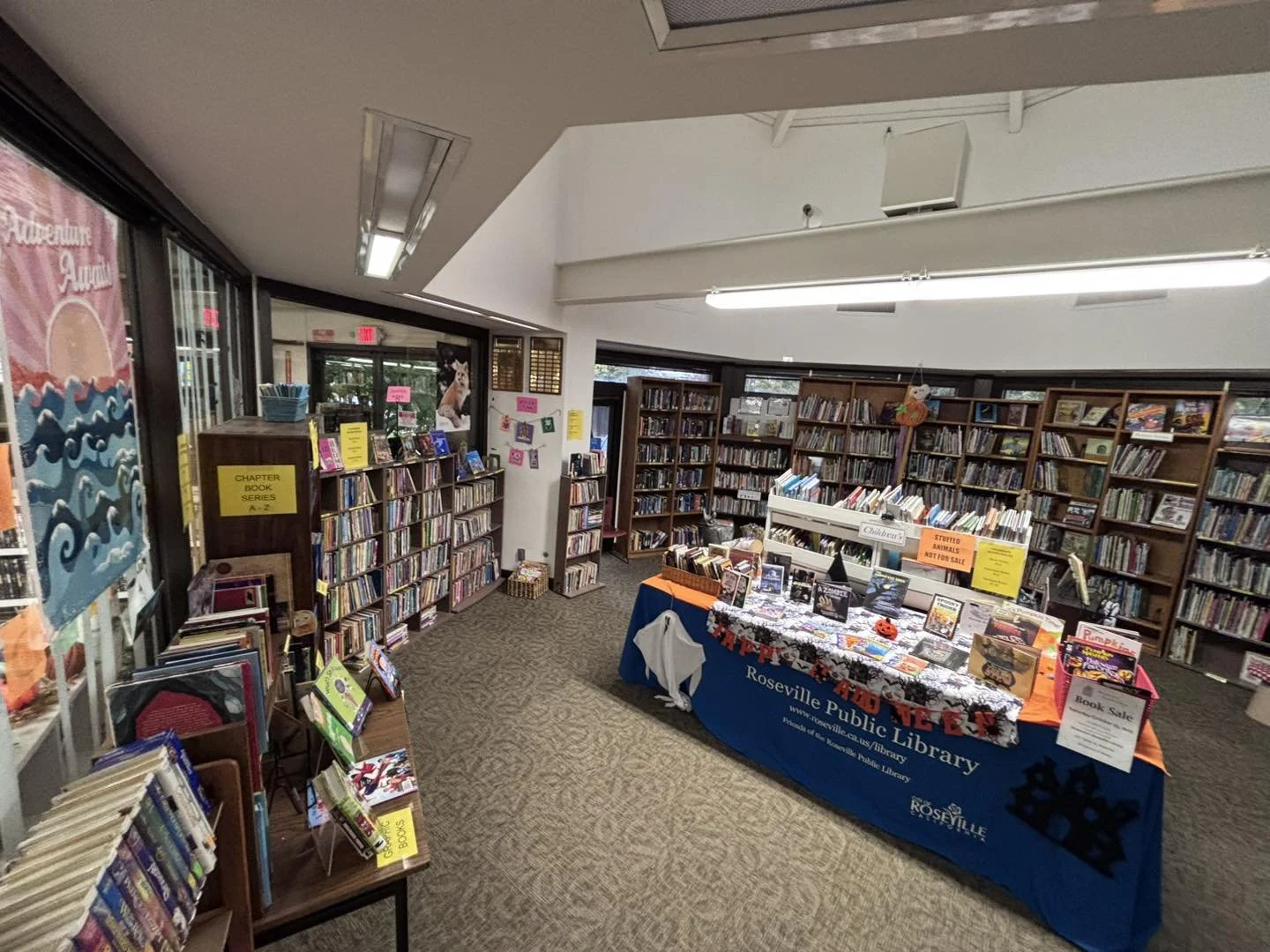

Did you know you can include the Friends of the Roseville Public Library in your estate plan? Many people leave a charitable gift in their will and by naming the Friends as a gift of your property, your financial accounts, or even just a percentage of your estate, you can show your support for the Roseville Public Library and all the good it brings our community.

For donations of real estate or to contribute to our endowment fund, please coordinate with the Placer Community Foundation and request to make a planned gift to the Friends of the Roseville Public Library Endowment Fund.

For all other donations or if you have specific requests and would like to confidentially discuss a gift from your estate, please contact Ali Goff to discuss your wishes.

Resources:

Real Estate donations & Endowment Fund:

Placer Community Foundation

P.O. Box 9207

Auburn, CA 95604

530.885.4920

All other donations / questions:

Ali Goff

Goff Legal, PC

ali@gofflegal.com

916.625.6556

Sample Bequest Language

Following are examples of different types of gifts to the Friends of the Roseville Public Library. We suggest you have the language written or adapted by your attorney to ensure it meets your estate planning goals.

Sample Gift of Specific Asset

A specific bequest gives a specific item or specific piece of property to the Friends of the Roseville Public Library. Such bequests are fulfilled first, before cash and residuary bequests. If the donor disposes of the specified property during his or her lifetime, there will be no bequest to The Friends of the Roseville Public Library.

"I give [describe asset] to the Friends of the Roseville Public Library, TAX I.D. # 23-7217955, to further the objectives and purposes of the Friends of the Roseville Public Library. The Friends of the Roseville Public Library may be contacted in care of P. O. Box 232, Roseville, CA 95678, 916 746-1212."

Sample Gift of Specific Amount

A cash gift/bequest provides the Friends of the Roseville Public Library with a specified sum of money from a donor's estate. These bequests are fulfilled second, after specific and before residuary bequests.

"I give $[amount] to the Friends of the Roseville Public Library, TAX I.D. # 23-7217955, to further the objectives and purposes of the Friends of the Roseville Public Library. The Friends of the Roseville Public Library may be contacted in care of P. O. Box 232, Roseville, CA 95678, 916 746-1212."

Sample Gift of Remainder of Estate

A residuary bequest is made from the residue, or what remains in a donor's estate after specific and cash bequests, taxes, settlement costs and debts are satisfied. This type of bequest is sensitive to changes in the size of the estate over time.

"I give, to the Friends of the Roseville Public Library, TAX I.D. # 23-7217955, all [or state the fraction or percentage] of the rest, residue, and remainder of my estate, both real and personal, to further the objectives and purposes of the Friends of the Roseville Public Library. The Friends of the Roseville Public Library may be contacted in care of P. O. Box 232, Roseville, CA 95678, 916 746-1212."